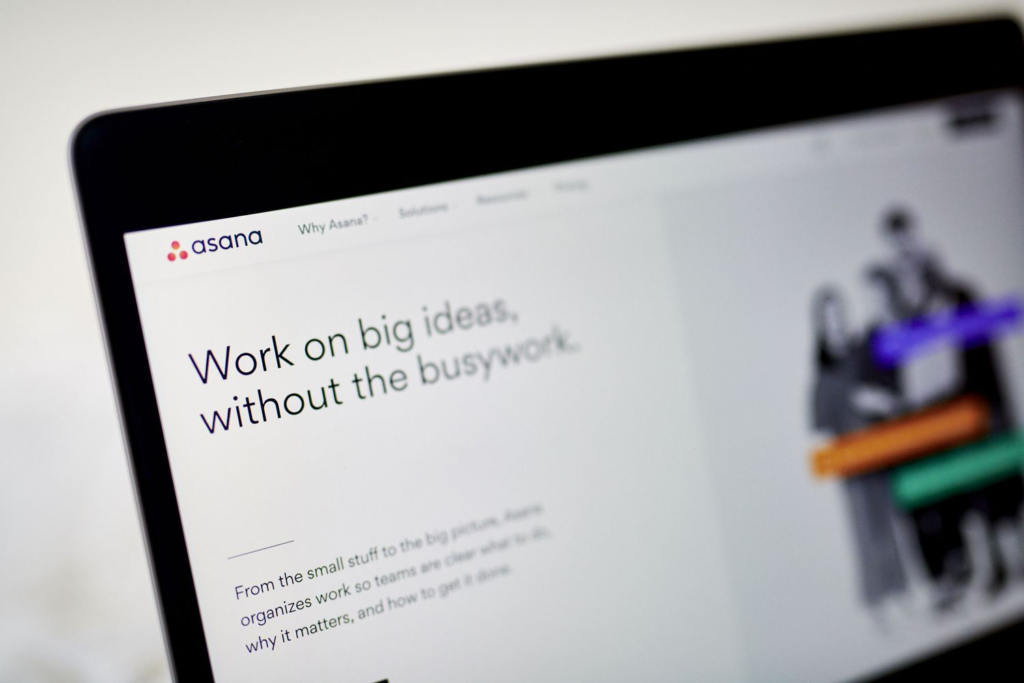

Understanding Asana Stock: Everything You Need to Know

Asana stock represents shares of Asana Inc., a leading work management platform based in the United States. Investors are interested in Asana stock due to the company’s innovative tools, steady growth, and expansion into AI-driven solutions. Understanding Asana’s stock can help you make informed investment decisions.

What Is Asana?

Asana is a work management software company that helps teams organize, track, and manage their work. Founded in 2008 by Dustin Moskovitz, a co-founder of Facebook, and Justin Rosenstein, Asana’s primary goal is to improve team collaboration and productivity. The platform offers various tools, such as task management, project tracking, and workflow automation, catering to businesses of all sizes. With millions of users worldwide, Asana has become a staple for companies looking to streamline their operations.

What Is a Stock?

A stock represents a share in the ownership of a company and constitutes a claim on part of the company’s assets and earnings. Stocks are typically bought and sold on stock exchanges and serve as a key investment vehicle for individuals and institutions. By purchasing stock, you essentially become a part-owner of the company, which can offer potential financial returns through price appreciation and dividends. Stocks are divided into common and preferred categories, with common stockholders having voting rights and potential dividends.

How Does Asana’s Stock Work?

Asana’s stock, traded under the ticker symbol “ASAN” on the New York Stock Exchange (NYSE), allows investors to buy shares and become partial owners of the company. The stock’s value fluctuates based on market demand, company performance, industry trends, and broader economic factors. Asana generates revenue primarily through subscription services, and its stock price often reflects investor confidence in the company’s ability to grow and expand.

Investors watch quarterly earnings reports, user growth, and new product releases to gauge how the stock might perform. Significant news, such as the launch of new features like the AI Studio, can also influence stock prices.

Why Do People Buy Asana’s Stock?

Investors buy Asana’s stock for several reasons:

- Growth Potential: Asana operates in a growing industry where demand for project management tools continues to rise.

- Innovation: The company invests heavily in new technologies, like its AI tools, to enhance user experience.

- Strong Leadership: Co-founder Dustin Moskovitz brings credibility and tech industry experience.

- Expansion Opportunities: Asana’s international reach and expanding user base are promising for future growth.

Risks of Buying Asana’s Stock

While Asana stock offers growth opportunities, there are risks to consider:

- Market Competition: Competitors like Trello, Monday.com, and Jira could affect Asana’s market share.

- Profitability Concerns: Despite revenue growth, Asana has yet to consistently post profits.

- Economic Downturns: Market volatility and economic downturns can negatively impact stock prices.

- Technological Changes: Rapid changes in technology may require costly innovations.

How to Learn More About Stocks

If you’re new to investing, consider these steps to learn more:

- Read Books and Online Guides: Resources like “The Intelligent Investor” offer foundational knowledge.

- Follow Market News: Stay updated with platforms like Bloomberg, CNBC, and financial news apps.

- Consult Financial Advisors: Professionals can provide personalized investment strategies.

- Use Investment Apps: Tools like Robinhood and E*TRADE offer user-friendly platforms for beginners.

How is Asana’s stock performing?

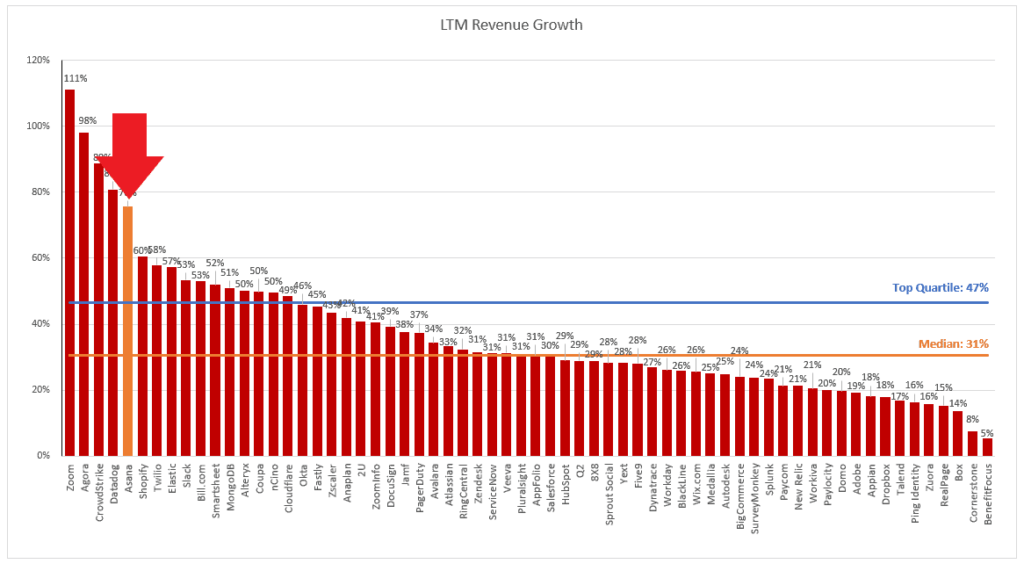

Asana’s stock performance has seen fluctuations since its IPO in 2020. Initially, the stock surged as investors were optimistic about the growing demand for remote work solutions. However, like many tech stocks, Asana has experienced periods of volatility. Earnings reports indicate steady revenue growth, but concerns about profitability have occasionally dampened investor enthusiasm.

In recent quarters, Asana’s focus on enterprise customers and AI-driven tools has contributed to stabilizing stock performance. Analysts often cite user growth and product innovation as positive indicators, though they caution about competitive pressures and market conditions.

What is AI Studio?

AI Studio is Asana’s latest innovation, designed to integrate artificial intelligence into project management workflows. This tool uses machine learning to automate task assignments, predict project timelines, and offer data-driven insights. AI Studio aims to enhance productivity by reducing manual work and providing actionable recommendations to users.

By leveraging AI technology, Asana hopes to differentiate itself in a crowded market and attract larger enterprise clients seeking advanced solutions.

Analysts’ views on Asana’s stock

Financial analysts provide mixed but generally optimistic views on Asana’s stock. While some highlight the company’s innovative product suite and growth potential, others point to challenges related to profitability and intense competition.

How is Asana’s Stock Doing?

Currently, Asana’s stock shows moderate growth with some volatility. Analysts appreciate the company’s consistent revenue increases but stress the importance of achieving profitability. The adoption of AI technologies is seen as a potential catalyst for future gains.

Recent News About Asana

Recent headlines surrounding Asana focus on its AI Studio launch, partnerships with large corporations, and expansion into new markets. Investors view these developments as positive indicators of the company’s long-term strategy.

What Do Experts Say About Asana’s Stock?

Expert opinions vary:

- Bullish Analysts: Predict that Asana’s innovation and market demand could drive the stock price higher.

- Bearish Analysts: Warn that competition and high operational costs may limit growth.

- Neutral Analysts: Suggest holding the stock until clearer profitability trends emerge.

Asana’s New AI Tool

Asana’s new AI tool aims to revolutionize how teams manage projects. By analyzing vast amounts of data, the tool provides recommendations for task prioritization, deadline management, and resource allocation. Early user feedback has been positive, with many noting increased efficiency and reduced workload. This innovation not only strengthens Asana’s competitive position but also appeals to tech-savvy enterprise clients.

In conclusion

Asana stock presents both opportunities and risks for investors. The company’s commitment to innovation, particularly through its AI initiatives, positions it well for future growth. However, potential investors should remain aware of market competition and profitability concerns. By staying informed and considering expert analyses, you can make more educated decisions regarding Asana’s stock. Remember, investing always carries risks, so thorough research and professional advice are essential before buying shares.